I have sometimes referred to January as the Monday of the months, especially one after a particularly nice festival holiday season and now you are trying to find your groove back or rather get back into the rat race, paper chasing.

January always feels as if it has way more days than all the other months put together, more so for those who over indulged during the holiday season and spent way more than they should and now counting the days to the January payday. Meanwhile, its beginning of the year, bills and expenses have piled up, groceries and basics are running, then there’s school fees and uniforms, oh and inflation adjustment while you are playing hide and seek with the landlord.

These January Financial Blues are sometimes referred to as January Disease (not to be confused with the cattle disease Theileriosis which is spread by ticks and known as January Disease because of its prevalence during the January rainy season). The most common cause of the January Disease is a lack of financial planning coupled with impulse expenditure during the holidays. The festive mood is a consumerism trap by capitalism to make you to loosen the purse strings to savings you had been carefully stocking up. Now here you are, trying to convince yourself nothing tastes better than cabbage because that’s all you can afford.

January Log Standings

P W D L Points

1.Cabbage 06 6 0 0 18

2. Soya 06 4 1 1 12

3. Rice 06 1 2 3 05

4. Meat 06 1 0 5 03

5. Liquor 06 0 1 6 01

How to beat the January Disease financial blues:

According to the Consumer Council of Zimbabwe executive director, “People should draw up budgets with their families and consult each other on priorities. Proper planning helps eradicate the ‘January disease’ from consumers as they would not have overspent through buying things that were essential and of priority.”

Budget

Plan and have proper budgets with families, consulting each other on expenses at the same time listing priorities such as:

•Rentals

•Utility bills

•Medication

•Groceries

•Transport and travel expenses

•Make provision for expenses such as school fees which may include uniforms and stationery that need to be saved up for.

*Stick to your budget don’t be distracted by flashing lights, sales and discounts of things not on your budget…. Always shop around for discounts, do price comparisons before finalising.

Savings

Throughout the year, you should have a system of managing your savings, so you know how much you will have saved by the end of given period or at the end of the year and what you will use it for alongside the budget you will have drafted.

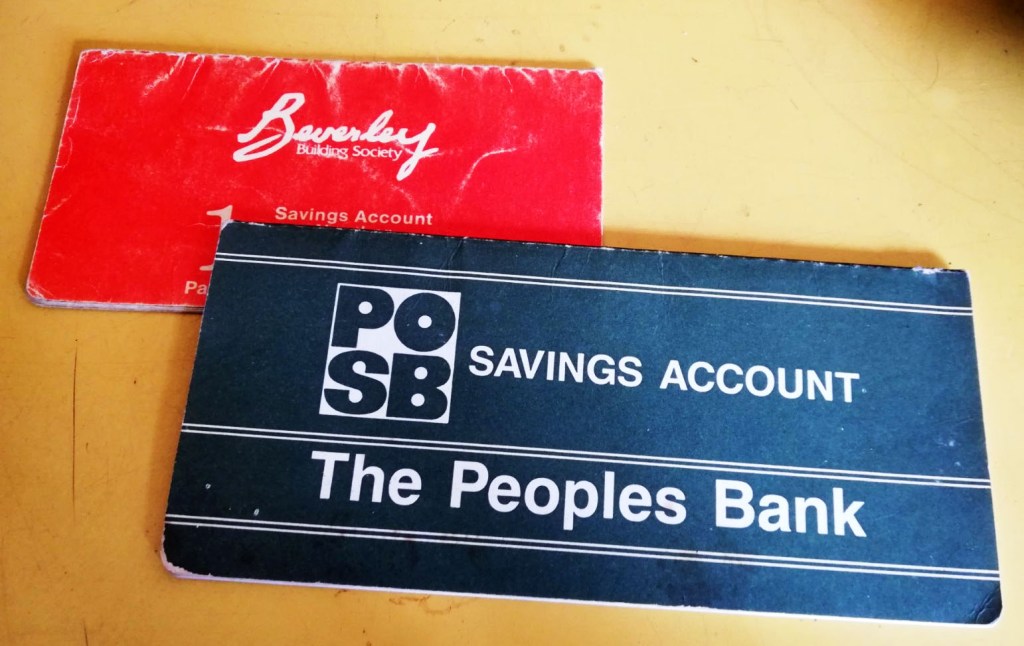

Growing up banks used to issue Bank Savings Books and each time you went to make a deposit or withdrawal they would update an entry in the book to reflect the transaction and authenticate it with a bank stamp. At any point you knew precisely how much was in the bank by looking at the book. It was also easy to keep track of your expenditure.

In this digital age of paperless transaction and electronic money, it should be easier to keep an eye on your finances but its also the easiest to spend the money as it is accessible any time at the swipe of a card or push of button using internet banking and mobile banking wallets.

The beauty of technology is that you can use online resources such as SavingsCalculator.org which has a number of calculators you can use to estimate your savings or to calculate how long it will take to reach a savings goal.

Once you have a goal and a budget, you can work towards those, with a bit of financial discipline you can live within your means and still have a budget to treat yourself to some nice things once in a while too.

If you subscribe to NMB i.e National Mattress savings Bank, it might be harder to exercise financial restraint as the money is readily accessible and thus easy to spend. You may need to entrust it to someone better disciplined or lock it away and have someone else keep the key… Of course prudence recommends one banks their money at a financial institution, but as one who has lived through an era where the banking services collapsed eroding savings I understand why one would rather keep their money close to them than bank it.

Investments

Where possible invest in other streams of income so you are not just waiting on the one paycheck.

Invest in assets that can increase in value over time such as stocks or boost your productivity or reduce expenditure like a home printer.

Invest in yourself! Upgrade your skills, get accreditation, professional certificates or further academic qualifications that make you high value which means a bigger paycheck at the end of the day.

Plan for the future

We might not be able to predict the future but we can plan for it. That is why we have medical insurance, funeral policies, life insurance firms. Plan for your retirement, when will you retire or how much will you require to retire and live comfortably?

Do you ever suffer from the January Disease? How would you describe your financial navigation model?

~B

Leave a reply to Josh Gross Cancel reply