If you were having coffee with me, I would happy you came to visit. We would sit in the winter sun that feels like it’s on power-saving mode and have a cup of coffee, while I tell you what has been happening in the Reserve Bank Of this Teapot-shaped Kingdom Of Funny Money.

You remember last week, I shared with you how I was dreading going the shops because I just knew that the price tags of would be going crazy… With effect from Tuesday, the 23rd of June, a new Reuters Based Forex Auction would now be used to determine the official exchange rate and not the one where the Reserve Bank Of Zimbabwe would have it fixed at 1:25.

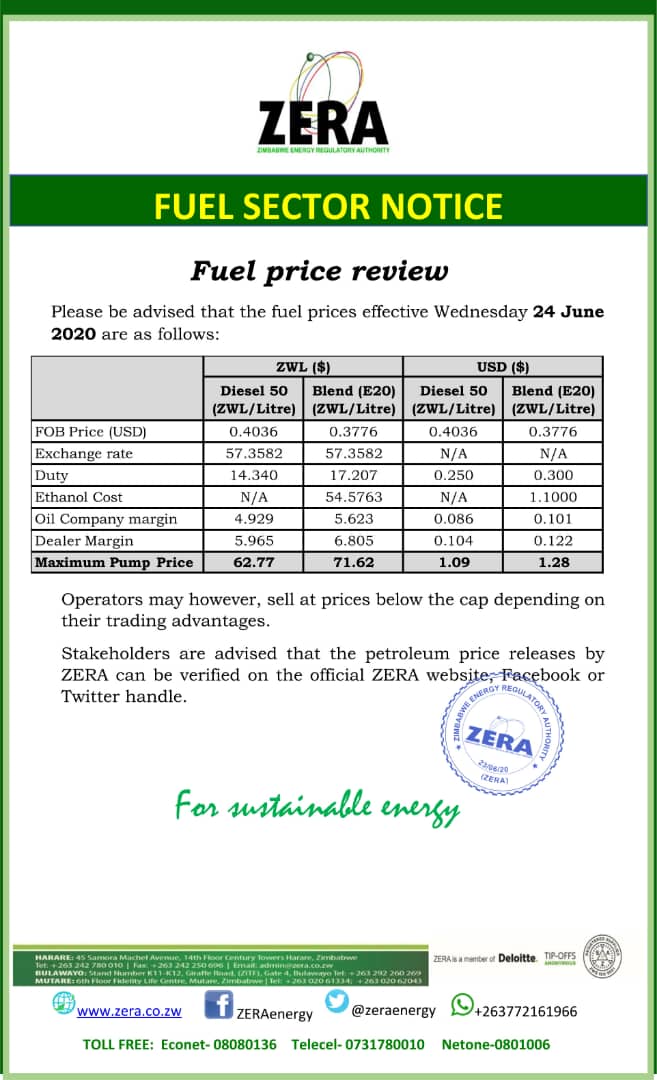

If you were having coffee with me, I would tell you that in the first of the Tuesday weekly forex auctions which had a bid spread of $25,4 and $100, a bid average of 57.358 was set as the official forex rate, now we await the next Tuesday to see how the market will react, but in the meantime:

Bread, which went up a fortnight ago has gone up again. And using the new rate bread costs about somewhere at about USD$1.50

If you were having coffee with me I would tell you that the price of coffee would give one a caffeine shock.

The price of fuel went up by 150% in part due to the new forex auction but also the mandatory blending of petrol with 20% ethanol which contributes 76% of the petrol price. The strange part is that adding ethanol to the petrol is supposed to reduce the cost of petrol but the practise is actually making the fuel more expensive and some say it’s a profiteering practice by the company.

If you were having coffee with me, I would tell you that our economy has had acute cash shortages which have led to people buying money to get money, it may sound weird but it’s real. We live in a country where the value of money has a multi-tiered system; money in your bank account does not have the same value as money in your mobile phone wallet and that is not the same value as the scarce physical cash in hand and of course the United States Dollar is King if you can put your hands on it.

When money is the bank its called RTGS balance when its cash, it used to be the Bond Notes nut is now the Zim Dollar, when its in a mobile money wallet its called Ecocash and all of it is still ZWL which is Zimbabwean Dollars unless its in Nostro Accounts which are FCA but you can’t really withdraw that money. I have lost track of the number of times our currency has been rebranded, relaunched, re-introduced…

Some merchants will prefer one form of the currency while refusing another for example in the past week its reported some traders were refusing the Bond Notes which at one point in time had a value of 1:1 with the United States Dollar, possibly making it the strongest currency on the continent. A multi-currency system was introduced were people could transact using whatever currency they could find from United States dollars, to Euros and pounds even The Rand from South Africa, but that system was later stopped as it was said to fuel inflation and predatory pricing models.

Recently the use of the United States Dollar was brought back, the authorities say this was in response to the COVID pandemic and that we are not dollarizing again even as supermarkets and traders are being told to display prices in both Zim dollars and USD (using the official rate)

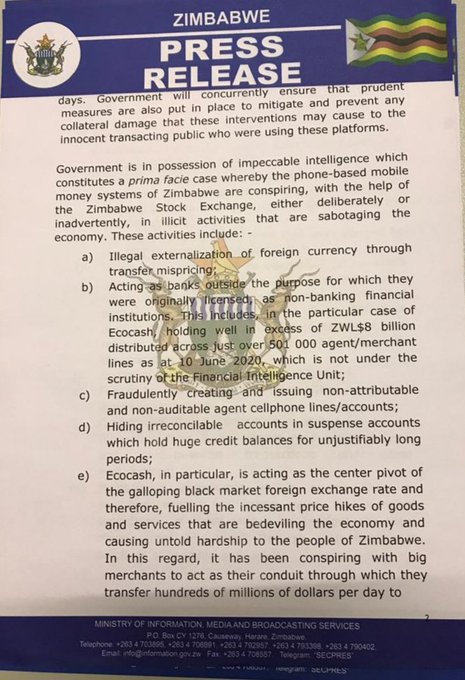

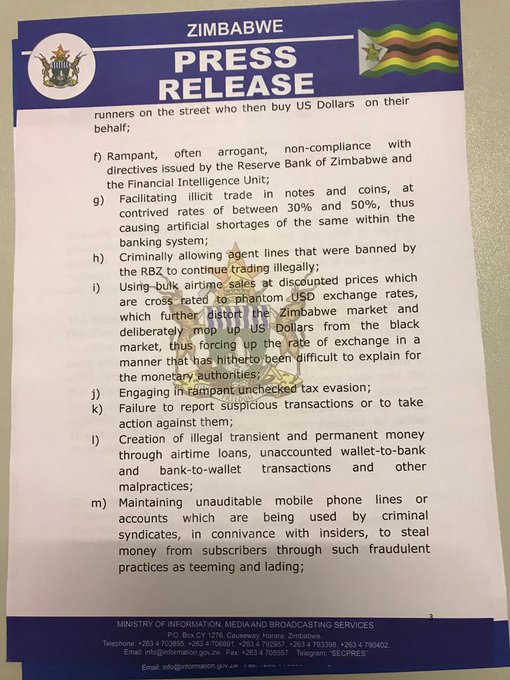

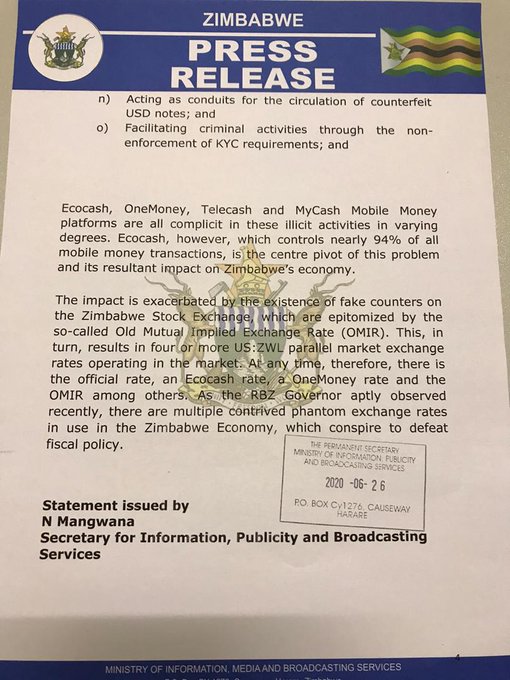

If you were having coffee with me I would tell you the greatest shock of all was when the perm secretary for Information read the riot act to mobile phone-based banking systems and practically throwing even the kitchen sink at them, blaming them for sabotaging the economy and the announced a suspension of the services.

This came with practically no warning, except for a few rumours which had been spread via social media that anyone with a balance in their mobile phone wallet should quickly use the money or transfer it back to bank accounts. When the statement had gone out on the news, I got a call from my mother worried about what would happen to the money she had in her phone mobile wallet. I assured her it would be fine but I really wasn’t even sure what all this meant.

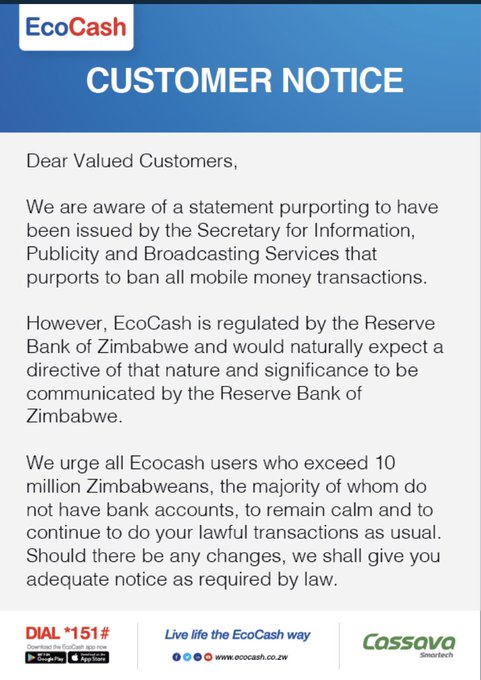

Later the mobile phone company that owns the largest network of mobile money banking Ecocash would release a statement advising everyone to stay calm as they had a subscriber base of over 10 million and we should continue our lawful transactions the EcoCash way.

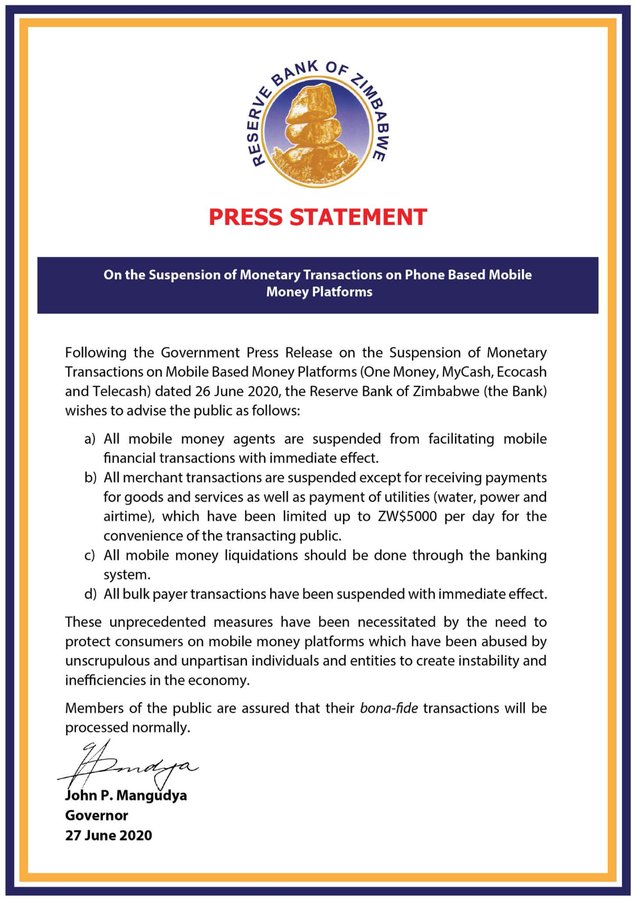

It felt like being caught between two quarrelling parents. Eventually, the Reserve Bank issued a statement on the suspension of agents and merchants but otherwise bonafide transactions will be processed normally.

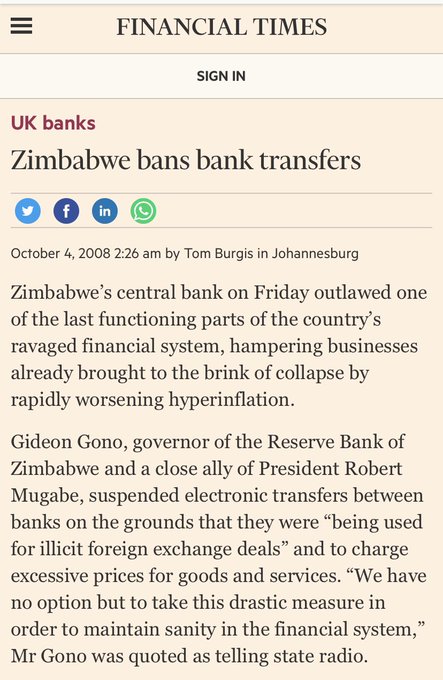

This is not the first time similar suspension have happened in 2008, bank transfers were suspended as they were said to be used for illicit foreign exchange deals.

If you were having coffee with me, I would tell you that its twelve years later and it seems we still go round and round, banning and unbanning; suspending and unsuspecting this funny money economy.

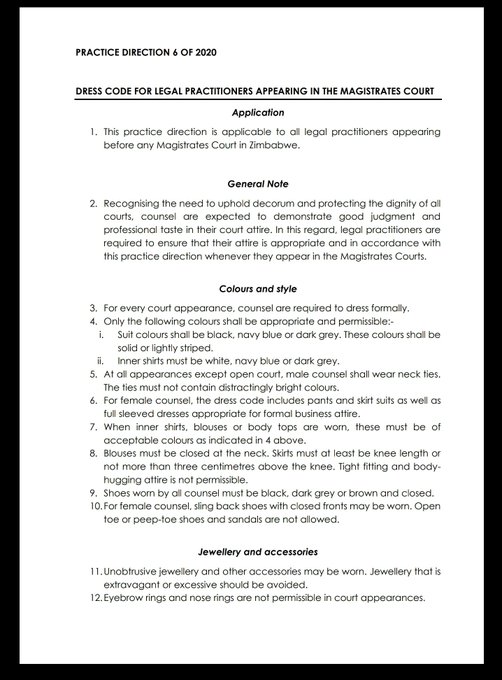

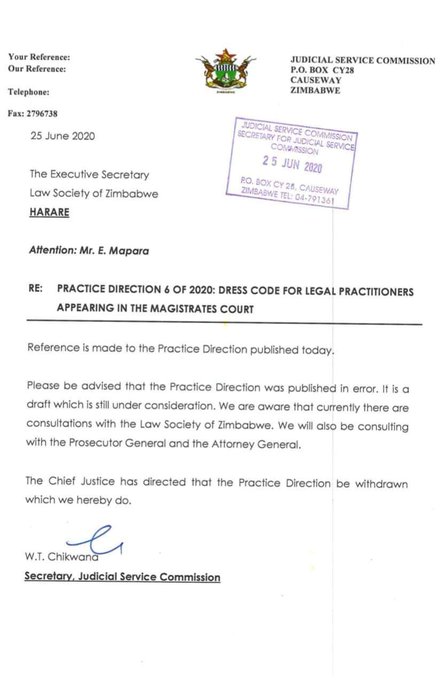

Oh and the judiciary service commission tried to ban miniskirts for lady lawyers but looks like they shelving that decision.. I had wondered who would go around with a tape measure to ensure one’s skirt was never more than 3cm above the knees.

If you were having coffee with me, I would show you a rare photo of the economic recovery blueprint our esteemed financial wizards are using to calculate the complex algorithm that will rehabilitate the economy.

~B

Leave a reply to mulos Cancel reply